This higher level of service will help AFSP participants reach a wider range of clients. The Enrolled Agent status is the highest credential the IRS grants, and it’s only given to those who have met a rigorous set of standards. Enrolled Agents are tax professionals who are federally enrolled agent salary authorized to represent taxpayers before the IRS. They have unlimited practice rights, meaning they can represent any taxpayer, any tax matter, and appeal to any office of the IRS. An enrolled agent specializes in tax issues, including audits, appeals, and collections.

Salary and Job Prospects

- However, most states require at least a bachelor’s degree, which might take four years to complete before attending the CPA exam.

- The EA credential requires passing a three-part exam administered by the IRS before applying for licensure.

- From bookkeeping to tax consultations and filings, the Pros can help.

- Furthermore, the EA designation is a federal credential, meaning that EAs have unlimited rights to perform practice across the US.

- Like EAs, they can also open their own practices to handle their own clients.

The average hourly rate for a CPA is between $30-$500 versus $28-$36 for a tax preparer EA, depending on qualifications, experience, and rank. CPA and an EA can lead to a difference in the provision of extended tax-related services and hourly rates. EA candidates who do not pass part of the exam may retake that https://www.bookstime.com/articles/truckers-bookkeeping-services section up to four times within the testing window. Taxes are incredibly complex, so we may not have been able to answer your question in the article. Get $30 off a tax consultation with a licensed CPA or EA, and we’ll be sure to provide you with a robust, bespoke answer to whatever tax problems you may have.

Division of Employer Accounts Assessments – NJ.gov

Division of Employer Accounts Assessments.

Posted: Tue, 10 Dec 2019 06:01:47 GMT [source]

Services Difference

- An enrolled agent specializes in tax issues, including audits, appeals, and collections.

- If, however, you’d like to work with a wider range of financial topics and have access to higher salaries, then becoming a CPA is the way to go.

- This makes the EA credential an attractive option for those who want to specialize in tax-related matters without delving into the broader scope of financial accounting and reporting.

- It allows them to provide the best possible services to their clients, whether they are offering specialized tax advice as an EA or a more comprehensive range of financial services as a CPA.

- This helps ensure the highest standards of practice and ethics are maintained.

That means if you need to file in more than one state and eventually need representation before that state in an audit or resolution case, the same EA can do it, Pinck says. As for employment situations, jobs for CPAs and EAs usually take place in different environments. They actually have their own clients and can, therefore, work at home with flexible hours. On the other hand, many CPAs start off in audit firms, but as they accumulate experience, they can launch their own practices and acquire their own clients. Most people consider Part 1 (Individuals) and Part 3 (Representation, Practices, and Procedures) to be the easiest. In fact, some experienced tax professionals can pass these parts without much studying.

Costs and Processes of Becoming an EA and CPA

- We were told some teams have called EA Sports to let them know of crowd blackout plans later this season to be included in the game.

- Top earners (90th percentile) are estimated to make $107,500 annually.

- EAs are federally authorized to represent taxpayers before the IRS and have unlimited representation rights.

- Alternatively, candidates can become an EA if they work for the IRS in a qualified position for five years.

- After you have formed your business, an enrolled agent can explain to you which business expenses are deductible from your taxes.

- Take into consideration not just the EA vs CPA salary, but also the educational qualifications, continuing education requirements, and the kind of work-life balance each profession offers.

If you take one thing away from reading this, it’s that running the ball is actually fun. The blocking AI is really well done, and players are rewarded for hitting the hole. The game has new physics-based tackling, based on where and how hard a hit is made, that looks much more realistic than Madden 24. Breaking tackles or falling forward through them becomes more likely if you follow blockers correctly. Trump was indicted on March 30, 2023, and charged with 34 state counts of falsifying business records in the first degree, a felony in New York. To raise the awareness of the difference amongst these, I thought I’d provide a brief summary of the specifics of each job title.

EA vs CPA Exam and Credential Requirements

Chris Fowler was on hand in Orlando to talk about his commentating for the game, and it was clear he’s still quite upset that ESPN blocked him from being in the game in the past. ESPN itself is not in this game as a brand, but its commentators are. There is no ESPN logo on the score bug, which has been relocated to the bottom of the screen. The pageantry and the environments are what really separate college football from every other sport, and the video game reflects that.

Enrolled Agents vs. Other Tax Professionals

CPAs can also provide money management and financial planning services to clients. Whether you’re looking to establish a financial route, open your own business, or build savings for a new home, CPAs are a fantastic option when you need a broad scope of financial expertise. In addition to passing the SEE, qualified EAs also have ongoing education requirements of at least 72 hours of training every three years. An EA also must meet ethical standards set by the US Department of Treasury. This helps ensure the highest standards of practice and ethics are maintained. In order to become a qualified EA, applicants must pass what is called the Special Enrollment Exam, or SEE.

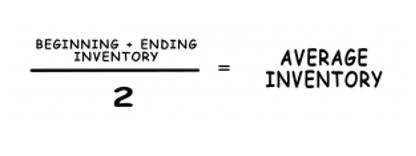

CPAs can offer a holistic approach to your business and personal financial needs, from tax planning to strategic financial planning. The commitment to ongoing education ensures that both EAs and CPAs maintain the highest level of expertise and ethical standards. It allows them to provide the best possible services to their clients, whether they are offering specialized tax advice as an EA or a more comprehensive range of financial services as a CPA. One of the most compelling factors when choosing between becoming an EA or a CPA is salary. As of 2023, Certified Public Accountants generally earn more, with an average annual salary of $77,370, compared to the $60,725 average for Enrolled Agents. While CPAs earn more, many tax professionals find the EA path more fulfilling due to its micro focus on tax issues and less rigorous exam cycle.

The pre-snap options are deep

If you have any questions about this subject or about what type of help is best for your tax and bookkeeping situation, please comment below or contact us. That concludes my breakdown of the differences of a CPA, EA, and a bookkeeper. If all goes as planned, I will take the last test this summer and will receive my CPA designation by the end of the year. Our firm Partner, David Knecht, wrote a great article explaining what type of tax help your company really needs.

Deixe um comentário